The Retail Banking Transformation Through Interactive Financial Literacy Experiences for Gen Z Customers

Traditional banking institutions face a challenge in connecting with Generation Z customers, who have different expectations due to their upbringing in a digital-first world where convenience, transparency, and personalization are baseline expectations, born between 1997 and 2012.

Understanding the Gen Z Financial Mindset

Financial independence matters more than ever to this generation that witnessed their parents navigate the 2008 financial crisis and more recently, pandemic-related economic uncertainty. Research shows that 72% of Gen Z believes financial literacy is essential, yet only 35% feel confident in their financial knowledge.

This disconnect represents both a challenge and an opportunity for retail banks. The institutions that bridge this gap through interactive financial literacy experiences aren't just performing a service—they're securing their future customer base.

Why Traditional Banking Approaches Fall Short

Traditional financial education methods—pamphlets, static websites, and occasional workshops—fail to resonate with digital natives who consume information differently. Gen Z customers expect:

Immersive learning experiences rather than passive information consumption

Gamified elements that reward progress and create engagement

Personalized financial guidance that reflects their unique circumstances

Community-based learning that fosters connection with peers

Banking institutions clinging to conventional approaches risk becoming irrelevant to this crucial demographic that will soon represent the largest consumer segment worldwide.

The Transformation Through Interactive Experiences

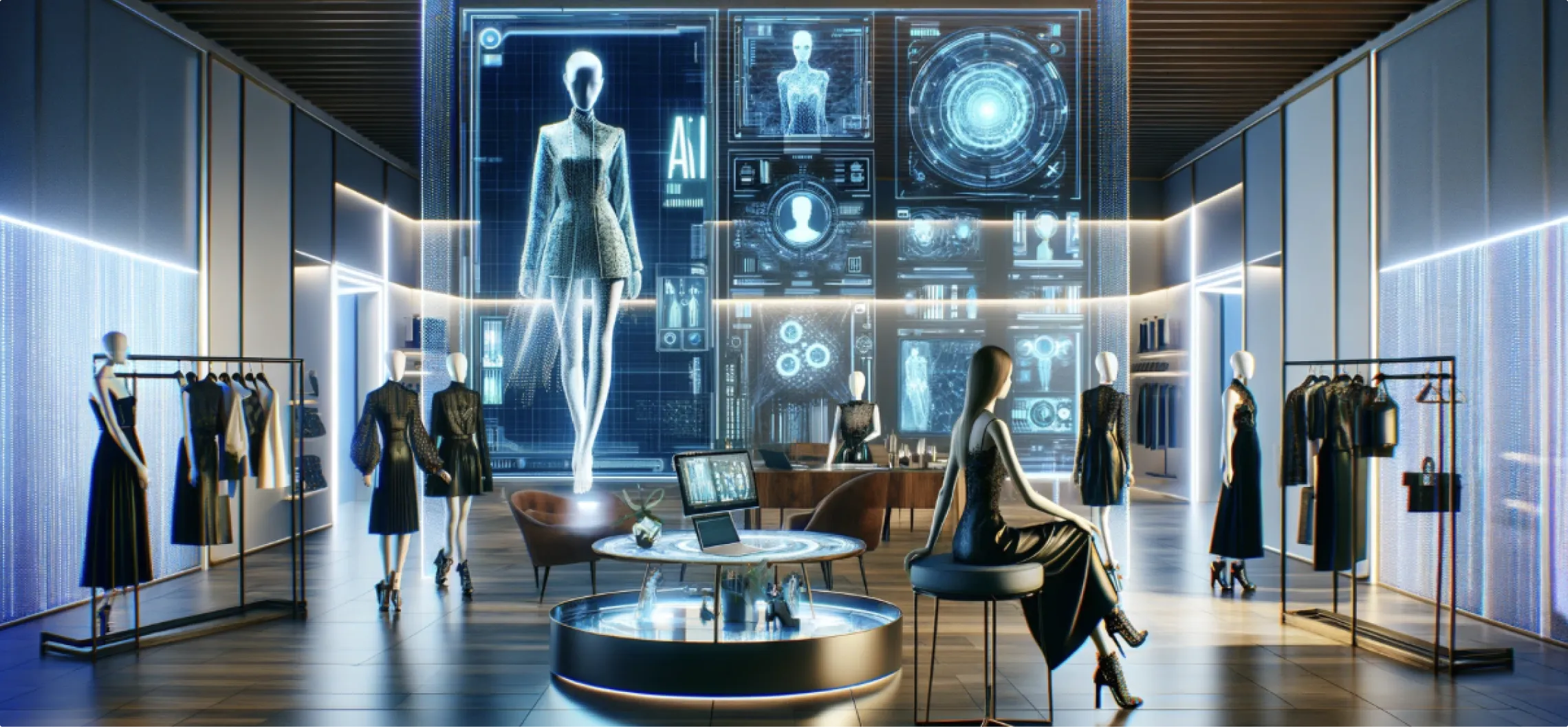

Forward-thinking financial institutions are reimagining customer engagement through technology-driven experiences that make financial literacy accessible, engaging, and personally relevant.

Virtual reality simulations now allow users to visualize their financial futures based on different decisions. Imagine experiencing the long-term impact of consistent retirement savings versus minimal contributions—not through charts and numbers, but through a virtual walkthrough of your future living conditions.

Augmented reality applications overlay financial information onto real-world settings, transforming abstract concepts into tangible experiences. For example, scanning products while shopping can instantly show the true cost of purchasing with different payment methods, including credit card interest calculations.

AI-driven financial coaches provide personalized guidance based on individual spending patterns, goals, and risk tolerance, creating educational moments within the natural flow of banking activities rather than as separate learning experiences.

The Cultural Component of Financial Education

Beyond technology, successful banking transformations recognize that financial literacy is deeply cultural. Gen Z's approach to money is influenced by:

Social impact considerations with 67% preferring brands that align with their values

Entrepreneurial mindset with nearly half interested in starting their own businesses

Skepticism of debt having witnessed the burden of student loans on older peers

Preference for transparency in all financial dealings and fee structures

Effective financial literacy programs address these cultural factors while providing practical education.

Implementation Challenges and Solutions

Creating these experiences requires significant expertise in emerging technologies, educational design, and Gen Z psychology. The most successful implementations typically involve:

Strategic needs assessment before technology selection

Cross-functional teams including both financial experts and experience designers

Iterative development with continuous feedback from target users

Metrics beyond engagement that track actual financial behavior changes

Looking Forward

The retail banking institutions that will thrive in the coming decade understand that financial literacy isn't just a corporate social responsibility initiative—it's a strategic imperative. By creating interactive, technology-driven experiences that make financial education engaging and personally relevant, these institutions build relationships with Gen Z customers that extend well beyond simple transactions.

In this transformed banking landscape, success comes not just from offering competitive products but from empowering customers with the knowledge to make sound financial decisions through experiences that resonate with their digital expectations and personal values.

Contact Us Now:

.CNhas5IL_ZqBJiz.webp)